Disinheriting a family member is one of the most difficult and emotionally charged decisions an individual can make during the estate planning process. Whether it stems from long-standing estrangement, personal conflict, or practical concerns about how assets should be distributed, the choice to exclude someone from a will is never taken lightly. In Florida, this decision also comes with a unique set of legal challenges.

In this guide, we’ll explore the valid reasons someone may choose to disinherit a loved one, the legal obstacles that often arise, and the tools available to help protect your intentions while minimizing the risk of conflict. If you’re considering disinheriting a family member in Florida, it’s essential to approach the process thoughtfully and with the help of an experienced estate planning attorney.

What Does It Mean to Disinherit a Family Member?

To disinherit a family member means legally excluding them from receiving any assets from your estate. This must be done clearly and intentionally in your will or trust; simply omitting a name may lead to disputes. While adult children or other relatives can often be disinherited, Florida law limits your ability to exclude a spouse or minor child. Disinheritance is a serious decision that requires careful legal planning to ensure your wishes are honored.

Can You Legally Disinherit a Family Member in Florida?

Yes, you can legally disinherit certain family members in Florida, but with important limitations. Adult children, siblings, and extended relatives can generally be disinherited through a properly drafted will or trust. However, Florida law protects spouses and minor children from complete disinheritance. A surviving spouse is entitled to an “elective share” of the estate, regardless of the will’s terms, and minor children may have inheritance rights tied to homestead property. To ensure disinheritance is valid, legal guidance is essential to avoid unintended consequences.

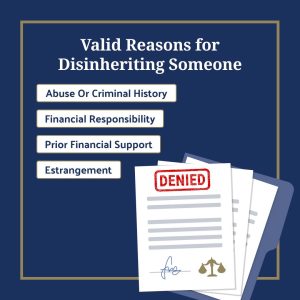

Valid Reasons for Disinheriting Someone

There are many personal and financial reasons someone may choose to disinherit a family member. While not legally required, documenting the reasoning behind your decision can help prevent disputes. Whether due to strained relationships, past behavior, or unequal support provided during your lifetime, clearly outlining your intent in legal documents is crucial for reducing the risk of challenges in probate court.

Estrangement or Lack of Contact

A common reason for disinheritance is long-term estrangement or minimal contact. If a family member has been absent from your life, by choice or circumstance, you may feel it’s inappropriate for them to inherit. In such cases, documenting this absence and intentionally naming them in the will as excluded can help reinforce your intent and prevent them from successfully contesting your estate.

History of Abuse or Criminal Behavior

When a relative has a history of abuse, manipulation, or criminal activity, legal disinheritance may be a protective measure. You may wish to shield your estate from individuals who have caused harm or cannot be trusted with assets. While this decision can be difficult, it’s often made to preserve peace of mind and ensure your legacy benefits those who align with your values.

Financial Responsibility of the Individual

If a family member consistently mismanages money, struggles with addiction, or faces significant debt, you may worry that an inheritance would be wasted or create more harm than good. Disinheriting them, or using alternatives like a trust with conditions, can provide greater control over how assets are used, while still protecting your broader estate plan from risk or loss.

Prior Financial Support Already Given

Some individuals choose to disinherit a family member who has already received substantial financial help during their lifetime. Whether through gifts, education, or property, prior support may be seen as an early inheritance. In such cases, you may wish to direct your remaining assets to others who haven’t yet received similar benefits, aiming to maintain fairness or balance within your estate.

Conflict with Moral or Personal Values

Sometimes, disinheritance stems from deep moral or value-based disagreements. A family member’s lifestyle, choices, or actions may conflict with your core beliefs, leading you to exclude them from your estate. While these decisions can be emotionally difficult, clearly stating your intentions in a will or trust can help reduce the risk of legal disputes and ensure your values are respected.

Legal Challenges That Can Arise After Disinheritance

Disinheriting a family member can open the door to legal challenges during probate. Even with a clearly written will, excluded individuals may contest it, claiming it was made under pressure or when you lacked capacity. These will disputes can delay asset distribution, increase legal fees, and cause emotional strain for your beneficiaries. Proper planning with an Orlando estate planning attorney helps protect your intentions and minimize future conflict.

Contesting a Will (Common Claims)

A disinherited heir may attempt to contest your will in probate court. The most common claims involve allegations of undue influence or that you lacked the mental capacity to create or update your will. These challenges often require evidence and testimony and can lead to drawn-out legal battles that undermine your estate plan and place added stress on your intended beneficiaries.

Undue Influence

Undue influence occurs when someone manipulates or pressures you into changing your will in their favor. This is especially common among vulnerable individuals who rely on others for care. Courts will look at factors like isolation, dependency, and sudden changes in the will to determine if it was made freely or under coercion. Strong documentation can help guard against this claim.

Lack of Capacity

Lack of capacity means the person creating or updating a will didn’t fully understand what they were doing. This often involves cognitive decline or illness. If challenged, the court may examine medical records, witness testimony, and the circumstances around the signing. Having your will executed under attorney supervision can help confirm capacity and protect your decisions from future disputes.

Burden of Proof in Probate Court

When someone contests a will, they bear the burden of proof to show it is invalid. This means presenting convincing evidence that the document was created under improper conditions. However, if the disinheritance seems suspicious or was poorly documented, courts may scrutinize your estate plan more closely. Proper legal preparation helps shift the burden back to those challenging your wishes.

No-Contest Clauses (and Limitations in Florida)

A no-contest clause discourages heirs from challenging your will by threatening to revoke their inheritance if they do. While this strategy is effective in many states, Florida does not enforce no-contest clauses. As a result, alternative strategies like detailed explanations and consistent estate planning are essential for reducing the likelihood of costly disputes after you’re gone.

Disinheriting Minors or Dependents

Florida law provides protections for certain individuals, including minor children and spouses. You generally cannot fully disinherit a minor child, especially from homestead property. Similarly, a surviving spouse is entitled to an elective share. Trying to exclude these individuals without proper legal planning can result in court intervention and unintended outcomes for the rest of your estate.

How to Properly Disinherit Someone in Florida

To effectively disinherit someone in Florida, your estate plan must be intentional, precise, and legally sound. A vague or incomplete will can lead to confusion and court challenges. Working with an experienced estate planning attorney helps ensure the correct language is used, your wishes are enforceable, and your plan remains compliant with Florida law, even as circumstances change over time.

Use Clear and Direct Language in Your Will

Use Clear and Direct Language in Your Will

Avoid vague phrasing or leaving someone out without explanation. Specifically name the person you intend to disinherit and state your intent to exclude them from receiving any portion of your estate. Clear, unambiguous language helps minimize confusion and reduces the risk of a successful challenge during probate or claims of accidental omission.

Include a Statement of Intent

A brief statement explaining your reasons for disinheritance can reinforce your decision and show the court you acted deliberately. You don’t need to include personal details, but clarifying your rationale can prevent misinterpretation and disputes. This added layer of transparency demonstrates that your choice was well thought-out, not due to mistake, coercion, or diminished mental capacity.

Consider a No-Contest Clause

While no-contest clauses discourage heirs from disputing your will, Florida does not enforce them. Still, including one may deter out-of-state litigation or add clarity for family members. Pairing this clause with other protective strategies, such as trusts, legal documentation, and professional guidance, can provide extra reinforcement to help ensure your wishes are followed without interference.

Keep Documentation to Support Your Decision

Maintaining detailed records that support your decision, such as letters, emails, or journals, can be valuable if your will is contested. These materials help show a clear history of your intent. Your attorney may also keep notes about conversations that clarify your wishes, which can be used in court if needed to validate the legitimacy of your estate plan.

Update Your Estate Plan Regularly

Your estate plan should evolve as your relationships and circumstances change. Failing to update your documents after major life events, like estrangement, reconciliation, or new additions to the family, can undermine your intent. Regular reviews ensure everything reflects your current wishes and complies with Florida law, offering stronger protection against challenges from disinherited individuals.

Alternatives to Full Disinheritance

In some cases, a complete disinheritance may not be necessary or ideal. There are alternative strategies that allow you to limit a person’s inheritance while still reducing the risk of legal disputes. Whether through smaller bequests, conditional gifts, or open communication, these approaches can help preserve family relationships and minimize challenges during probate while still honoring your estate planning goals.

Leaving a Minimal Inheritance

Rather than disinheriting someone completely, you can leave a minimal inheritance, sometimes just a token amount. This signals that the omission was intentional, not accidental. It also discourages that individual from contesting your will, since challenging it could result in losing even the small amount granted. This tactic is often used alongside a no-contest clause or additional documentation of intent.

Setting Conditions via Trusts

A trust allows you to set specific conditions on how and when a beneficiary receives assets. If you’re concerned about someone’s behavior, financial habits, or lifestyle, you can structure the trust to limit access or require milestones, like completing education or staying sober. This gives you control over your legacy while still providing support in a way you’re comfortable with.

Mediation and Open Communication Before Death

Sometimes, a difficult conversation can prevent future conflict. If appropriate, explaining your estate decisions while you’re still alive can ease tensions and avoid surprises. Mediation with a neutral third party may also help resolve disputes or misunderstandings among heirs. While not always possible, open communication can preserve family harmony and reinforce your intentions before your plan is ever contested.

Schedule a Consultation With an Estate Planning Attorney

Disinheriting a family member requires thoughtful planning, clear legal language, and a deep understanding of Florida’s inheritance laws. To ensure your wishes are protected and your estate plan is enforceable, it’s essential to work with experienced legal professionals. Our trusted Orlando estate planning attorneys are here to help. To get started, contact us today to learn more about the estate planning services offered by our attorneys.

Use Clear and Direct Language in Your Will

Use Clear and Direct Language in Your Will